Mr. Rastogi currently serves as the Chairman of the FinTech Association for Consumer Empowerment (FACE)

Mumbai, India, 16th April 2024: NPST, a leading provider of digital banking and payments technology solutions, has announced the appointment of Mr. Ram Rastogi (DIN: 07063686) as an Additional Director in the Non-Executive Independent category of the Company.

This addition to the Board aligns with NPST’s ongoing initiative to refresh its leadership, welcoming accomplished professionals with diverse backgrounds and extensive experience in the FinTech sector. Mr. Rastogi brings to the table a wealth of knowledge garnered over thirty years in the banking and digital payments landscape. His expertise spans various domains including payments, real-time decision-making, risk management, predictive analysis, and Reg-Tech.

Mr. Rastogi currently serves as the Chairman of the FinTech Association for Consumer Empowerment (FACE), a non-profit organization dedicated to advocating the interests of Consumer Lending FinTech companies to regulators, media, distribution platforms like Google Play Store, and other stakeholders.

Prior to his current role, Mr. Rastogi held pivotal positions at the State Bank of India, where he oversaw Strategy, Business Development, ATMs, Debit Cards, and Emerging Payment Systems. Notably, during his tenure as the Head of Product Development at the National Payments Corporation of India (2011-2017), Mr. Rastogi played a crucial role in driving the development of digital and real-time payment systems. His contributions were instrumental in the launch and growth of initiatives such as the Immediate Payments Service (IMPS), Unified Payments Interface (UPI), AEPS, Cross-Border Payments, Bharat Bill Payments System (BBPS), and other offline payment systems while ensuring compliance with regulatory standards.

Announcing the appointment, Deepak Chand Thakur, Co-Founder and CEO NPST, said; “We are thrilled to welcome Mr. Ram Rastogi to the NPST Board of Directors, one of India’s most distinguished thought leaders and respected banking industry veterans. NPST is executing an aggressive growth and expansion strategy in the digital payments space. Mr. Rastogi’s specialisms in digital payments and vast experience in navigating an evolving and vibrant regulatory and technology landscape makes him an invaluable asset to the Board. His insights will provide vital guidance in strengthening NPST’s product portfolio, risk and compliance frameworks and deepening partnerships across the ecosystem, with an aim to drive sustained, long-term industry and investor value.”

Speaking on his appointment, Mr. Rastogi said; “NPST, within a short span, has carved a name for itself in the emerging digital payments technology space. The company is on an incredible trajectory centered around innovative, new-generation offerings that serve all entities in the financial value chain. It’s a privilege and honor to join the Board at such an exciting growth phase. I look forward to working with the team and advancing NPST’s vision to be a leader in digital banking and payments.”

About NPST

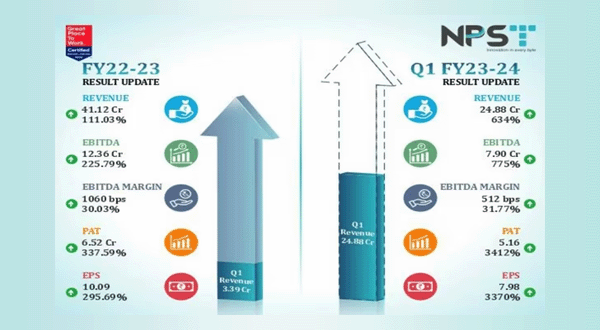

Established in 2013, NPST, a Make in India company, is one of India’s leading fintech firms, with a listing on the NSE Small and Medium Exchange.

With a primary focus on UPI payments and digital banking solutions, NPST functions as a Technology Service Provider (TSP) and a Third-Party Aggregator Provider (TPAP), catering to stakeholders across the financial value chain, including banks, merchant aggregators, merchants, and consumers. Committed to innovation and excellence, NPST’ aims to bridge the gap between banks and FinTechs and foster the overall growth of the digital payments’ ecosystem.

Presently, NPST facilitates seamless money movement for over 100 customers, processing an impressive 60 million transactions daily, benefiting millions of businesses, merchants, and consumers nationwide.